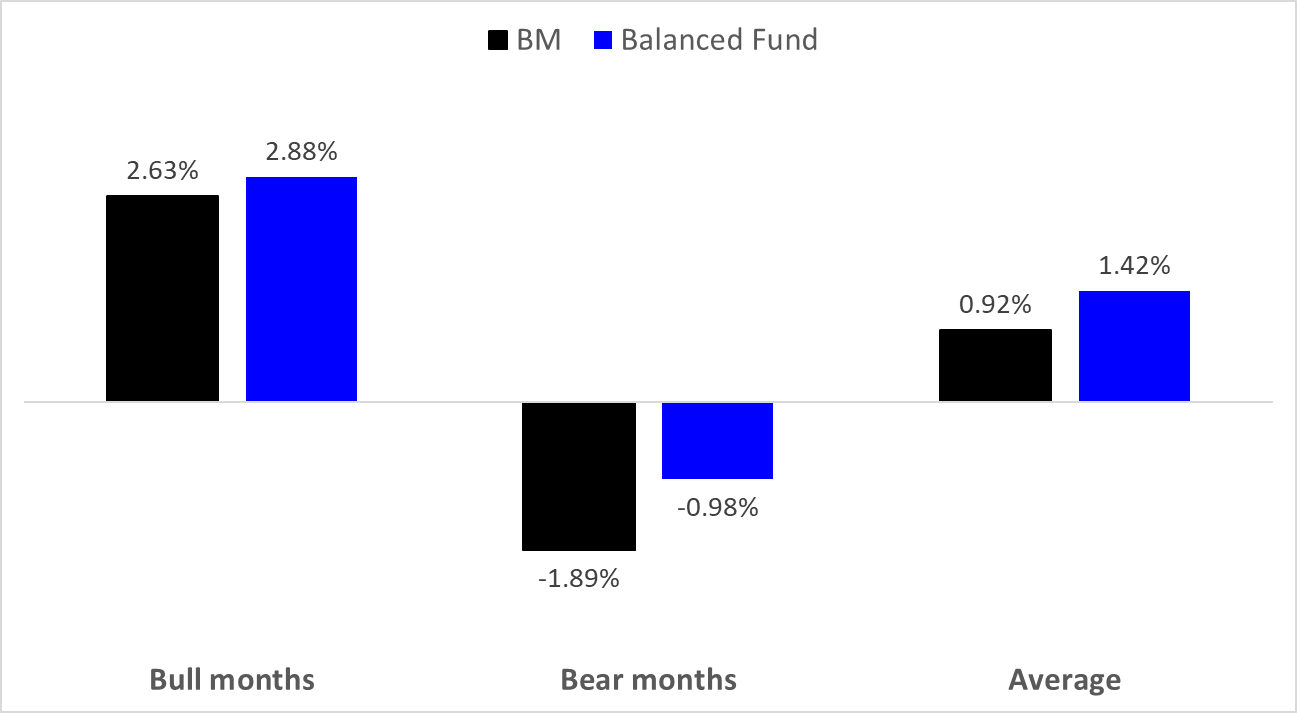

Outperforming on both the upside and the downside

The Visio BCI Balanced fund has a notable track record in both bull and bear markets. Co-portfolio manager Jonathan Myerson chatted to me about the asset allocation approach behind this success.

The Visio BCI Balanced Fund reached its five-year milestone towards the end of 2024. Over this period, it has been a stand-out performer in the ASISA South Africa multi-asset high equity category.

For the five years to the end of February, the fund showed an annualised return of 16.5%. That compares to a category average of 11.1%.

What is particularly notable is that it has shown the rare ability over this period to outperform the category average both when markets are going up, and when they are going down.

Source: Moneymate, Bloomberg, Visio Fund Managers

Co-manager Jonathan Myerson, who also manages the Curate Momentum Balanced Fund in exactly the same way together with Patrice Moyal, believes this is a result of the considered, risk-managed approach they take to asset allocation.

“What we look to find is the mix of assets that is going to give us CPI + 5% with the lowest volatility,” Myerson says. “We also want to minimise drawdowns, although that is secondary.

“Our official benchmark is the peer group, because that’s what everyone does. But, to be honest, you can’t model anything on the basis of what everyone else is going to achieve, because you don’t know what they’re doing.”

Asset allocation approach

The starting point for this approach, is a strategic asset allocation that has been optimised using historical data. This is the mix that Visio has calculated offers the highest probability of achieving its CPI + 5% goal with the lowest volatility.

“Every quarter, we then discuss how we can do better than that on a tactical basis,” Myerson says. “We don’t do it more than once a quarter unless there is a big market move, because we believe it becomes too noisy.

“So, effectively, the strategic asset allocation is passive. Over time, we’ve worked out that that is the mix that will give us the best chance to achieve our target. But we want to do a bit better than that by tactically moving, so we look at the expected returns from asset classes given their valuations and outlook, then run a process to see what mix of assets classes will give us the best return in the current environment.”

“Sometimes I prefer an asset mix that will get me to CPI + 5% with more certainty than something that could get me CPI + 7% with more volatility.”

Important in this process is that Visio also conducts a macro “sanity check”.

“In the quantitative process, each team gives their expected return from their asset class, we put that in the model and get the suggested TAA. But then we check to see where we are in the macro cycle to decide whether that allocation makes sense,” Myerson explains.

“For example, at the end of last year the model said we should be overweight domestic equity and domestic bonds. Given where we were in the inflation and growth cycle, that made sense to us, and so the quantitative and qualitative input aligned. But we thought the model was being too aggressive in its allocation, so we toned it down because we thought we could achieve our target with a smaller overweight in equity than what was presented.”

This illustrates how the fund is not designed to deliver the highest return, but the best chance of achieving its target.

Source: Visio Fund Management

“Sometimes I prefer an asset mix that will get me to CPI + 5% with more certainty than something that could get me CPI + 7% with more volatility,” Myerson says. “It’s not always that measurable, but we are always allocating within the context of what else is on offer.”

In this respect, the strategic asset allocation is seen very much as a “guardrail”. It provides Myerson with direction, but Visio does not put limits on how far the portfolio can deviate from it when making tactical shifts. This allows Myerson to make unconstrained decisions in finding the best risk-adjusted opportunities.

“For example, our strategic allocation to local equity is 45%, but the maximum exposure we’ve had is 60% and we’ve been as low as 38%,” Myerson (pictured below) says. “Those are quite big moves, and it’s seldom we get that aggressive, but we went to that maximum limit when we thought SA equities were materially better value than global equities, and they come with slightly lower volatility because you don’t have the currency effect.”

Equally, in offshore equities, the fund has a strategic allocation of 25%, but has been as high as 31% and as low as 9%.

Currently, the fund has 14% allocated to foreign equity, but 9% in foreign bonds.

“We think there is better value in fixed income than equity globally,” Myerson says. “Locally, we think it is much more balanced.

“That said, we are not looking for capital appreciation from offshore bonds. We are in shorter duration instruments. We are getting a 4% yield from US cash rather than investing in 10-year treasuries at 4.3% because we don’t think we’re going to get much capital appreciation from treasuries, and there is actually a risk yields go up to 4.5% or 4.7% and we lose some capital.”

This position also provides a relatively certain return, with a potential pickup in the case of rand weakness.

“Investing is US three-month paper at 4% might not give us CPI + 5% in rands on its own. But however close we get there will be with more certainty than most other asset classes right now,” Myerson says.