The success from "bottom-up asset picking"

It's a very small group of balanced funds that have returned over 10% per year over the last decade. I spoke to Aylett's Dagon Sachs, who manages one of them.

The Aylett Balanced Prescient Fund is among an elite group of just three multi-asset high equity funds that have returned more than 10% per annum over the past decade. It is also one of the top five performing funds in the category over the past five years.

The strategy is notable for being managed entirely agnostic of any strategic benchmark or asset allocation.

“We try to be bottom-up asset pickers,” says portfolio manager Dagon Sachs. “We want to find assets that we think are attractive, irrespective of what a benchmark may look like.”

“It’s all about the margin of safety”

This attractiveness is based on Aylett’s assessment of the intrinsic value of individual assets, and what the upside is to reach that.

“It’s all about the margin of safety given where they are currently trading versus what we think they are worth,” Sachs says. “But forecasting is not an exact science, so we always ask what if we are wrong. Are we going to lose money?”

The ideal investment for Sachs and his team is therefore one where the downside is limited and the upside potential is high.

The flow of money

“Investments with that optionality I would take every day of the week,” Sachs says. “And the money tends to flow to where we find the most ideas. It isn’t us saying we want more exposure to the US or South Africa, for example. We will take the money to where we see the best ideas with the most conviction. That results in the fund’s asset allocation.”

For instance, the portfolio bought heavily into South African bonds during the Covid sell-off.

“The R186 is something we bought in size because at the yields you were getting, even if the yield curve shifted up 1% or 2% over a year we weren’t going to lose money,” Sachs says.

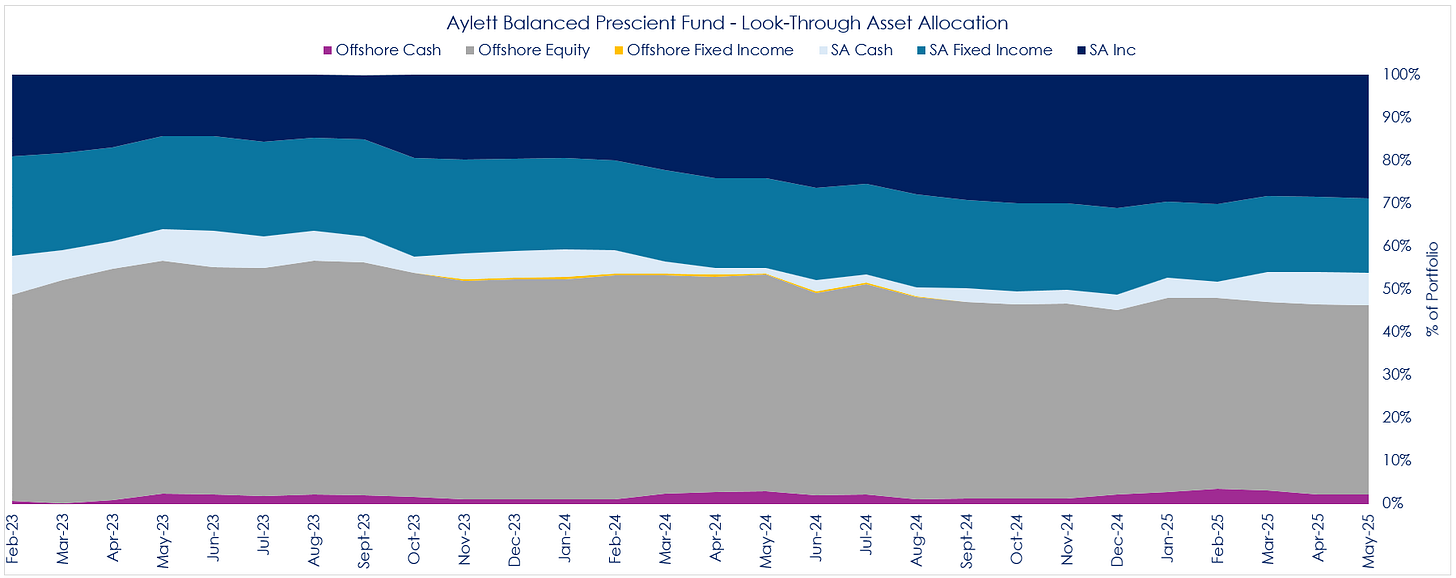

Similarly, the fund saw substantial opportunity in moving into local equities in 2024, increasing that allocation from around 30% to 50% in a few months.

Source: Aylett & Co. (31 May 2025). This is a look-through asset allocation that considers the underlying economic drivers rather than where an asset is listed.

“The amount of money in what I would call SA Inc. changed quite a lot at the beginning of last year as the asset values in South Africa just got cheaper and cheaper when people got negative ahead of the election,” Sachs says. “That buying moved the fund’s asset allocation as opposed to us saying we want SA equities.”

Being unconstrained by a benchmark or strategic asset allocation, Aylett is prepared to be highly flexible in the way the fund is managed. But this doesn’t mean that they make frequent large swings in allocations.

“We will move when opportunities present themselves, but we don’t trade the fund much,” Sachs says. “The fund turnover is about 10% per year on average.

“When we take a view, we can move quite fast”

“I think people talk a lot about being long term, but if you are turning over 10% of your fund every year, your average holding period is 10 years. From time to time when we take a view we can move and move fast, but on average that is the way we do it.”

Any asset selection is also always sense-checked with a macro view.

“We talk about building the portfolio bottom-up, and then worrying top-down,” Sachs says. “We don’t allow a macro view to drive what the portfolio looks like. But being aware of what’s going on in the world allows us to look at the resultant portfolio to be sure we are comfortable with any exposure we take.

“Ideally, I would love to find 15 fantastic equities in different parts of the world that are uncorrelated. That would be Nirvana.”

Sachs (pictured above) is also pragmatic in the way that the fund uses cash.

“Cash is the opportunity cost of what you’re buying, and so there are times when our cash can be quite high,” he says. “That can be a function of there being a limited number of ideas we have conviction in, or lower prospective returns compared to high cash rates on offer.”

In mid-2022, the fund’s cash position was as high as 20%.

This view of cash as being somewhat of a default position is particularly the case in the 25% of the portfolio that cannot be invested in equities.

“It doesn’t make a lot of sense to be at the long end”

“We can only be 75% equity, so for the other 25% we can own bonds or not own bonds,” Sachs says. “For us, that decision is about do we want to be in cash or do we want to own the bonds.

“At the moment, we are more on the short end of the curve. I have concerns, as I think the rest of the world does, around the deficit in the US and what that means for long-term bonds. If you throw in the disruption that Trump has caused, the weaker dollar tells you a lot about the trust that the world places in the US.

“What you always have to be cognisant of is that if there were to be a rise in long-term yields in the US, ours would follow. So, for us, it doesn’t make a lot of sense to be at the long end until we get a very steep yield curve where we can say the yield on offer takes care of that risk.”