Top balanced fund: “We don’t add a lot of alpha with asset allocation”

I believe a feature of great managers is knowing where to focus their attention, and understanding where can they add the most value. I chatted to Centaur's Roger Williams for his take.

The Centaur BCI Balanced fund has an outstanding long-term track record. Over the past 10 years it has returned an annualised 9.2%, making it one of the five top-performing multi-asset high equity funds in the country.

Not only is this return 2% per year ahead of the category average, it is also 0.5% above its composite benchmark and the fund’s strategic asset allocation. This is made up of:

40% Capped Swix

25% All Bond Index

24% Morningstar DM Index

11% SteFI

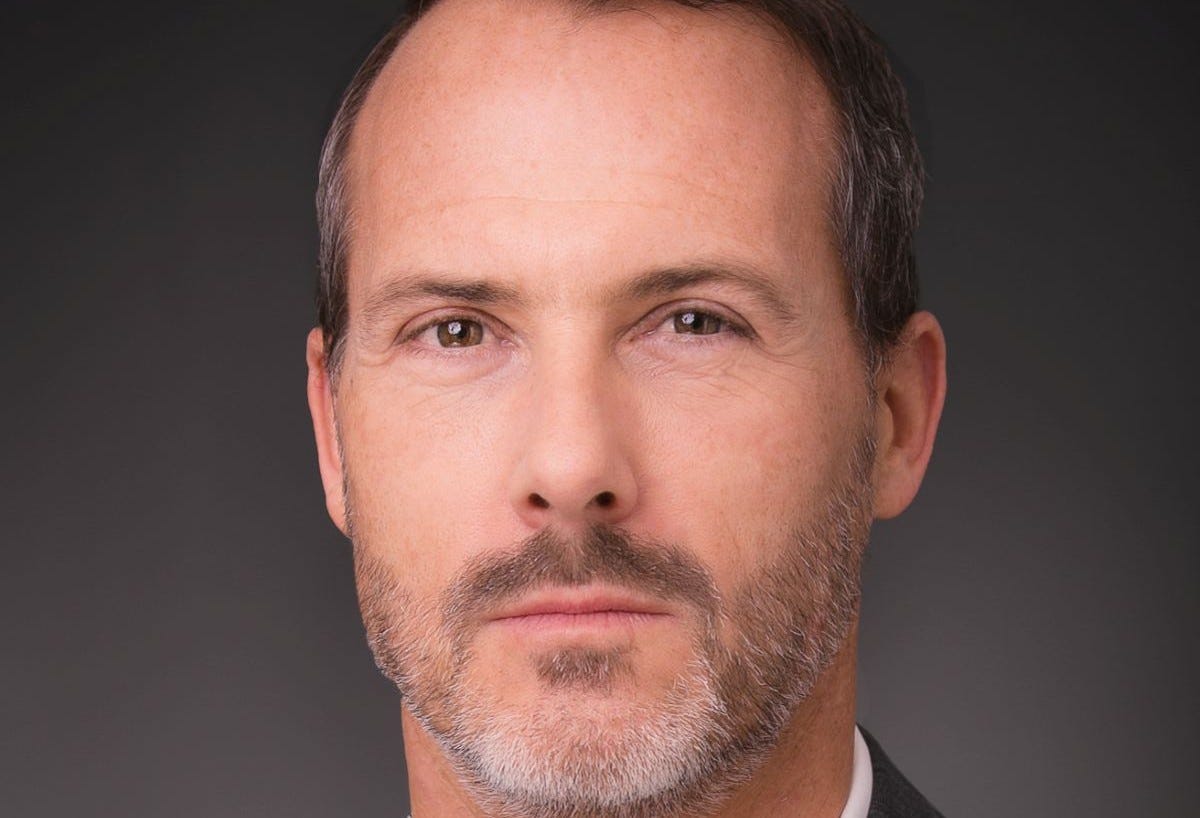

“Our benchmark would be one of the top-performing funds in the country as a passive benchmark,” points out co-portfolio manager and Centaur CIO Roger Williams (pictured below). “We use that as our starting point because our objective is to be close to number one. We’re starting with a hard benchmark, and we know we need to add incremental value above that.”

Significantly, Williams and co-manager Nick de Vos do not try to do this through much use of tactical asset allocation.

“Most of our alpha will come from stock selection.”

“We track our benchmark very closely,” Williams says. “Only if we have a strong view will we deviate materially from it, because we have worked out that this is optimal.

“Occasionally we might have an insight and move a lot of money, but that’s rare. We think it’s a very difficult thing to read markets. They are also very quantum calls and very infrequent. Most of our alpha will come from stock selection.”

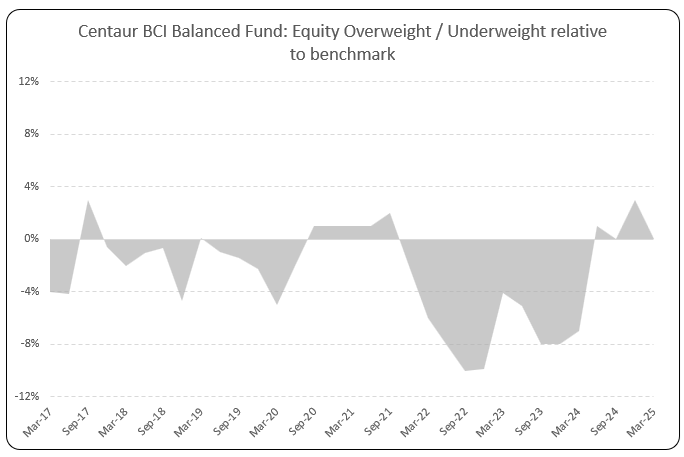

This does not mean a strict adherence to the strategic asset allocation, but rather that meaningful moves overweight or underweight will be infrequent, as the below graphic suggests.

Source: Centaur Asset Management

Williams explains that the fund’s strategic asset allocation has been calculated using historical data to generate an efficient frontier.

“We want to find the optimal mix of assets to get to our 4% real return outcome with the lowest risk,” Williams says. “We go back historically 20 years, 10 years, five years, and three years and see what combination of asset classes produced that outcome at the lowest standard deviation of returns.”

Recently, this quantitative work led Centaur to make a change to its strategic benchmark.

“With more data, it is more optimal to have a higher offshore weighting.”

“We used to have a lower weighting to offshore,” Williams says. “Previously, it was 48% the Capped Swix and 16% the Morningstar Developed Market Index, but we lowered the local equity weighting to 40% and upped the offshore weighting to 24%.

“The change to Regulation 28 was the major reason, but, with more data, it is more optimal to have a higher offshore weighting.”

He acknowledges that this would have been calculated taking into account some outsized returns from global markets over the past decade, but still believes there is enough opportunity for the change to be relevant.

“On a bottom-up basis, a lot of that outperformance has been in US tech stocks,” Williams (pictured above) says. “But we stock-pick globally, and we have seen quite exciting companies and business models in other areas which aren’t ridiculously overvalued. They are actually even more exciting than South Africa.

“We think that even if the global index doesn’t perform as well, we can find alpha generating opportunities which are at least as good as in South Africa, if not better.”

He adds that there is also an element of wanting to ensure enough diversification away from South African-specific risk.

“From an investor standpoint, there are risks that things in South Africa implode totally,” Williams says. “We had state capture, and we’ve had the fiscal deficit growing, so there are risks, and there are precedents around the world for this happening. It’s prudent from that perspective to have a bit more offshore.”

Minimising risk

Centaur’s focus on equity stock selection also means that Williams and De Vos look to minimise individual security risks in the rest of the portfolio.

“The fixed income allocation in the fund is extremely simple,” Williams says. “We only invest in government bonds, and don’t take any credit risk.”

Allocations are done off the back of a quantitative model that tracks the duration of the All Bond Index. The fund may move tactically within 5% to 10% of that duration, identifying the most attractive points on the curve.

“It’s largely a passive strategy.”

“One strategy we have employed quite successfully is riding the curve,” Williams says. “For example, if there’s 12-year bond moving towards 10, there is often a re-rating gap as it approaches because the 10-year is like a benchmark. So, you could see as much as a 2% yield pickup on those bonds relative to the 10 as it approaches.”

He adds that the bond portfolio has generated around 0.5% alpha per annum.

“We think it’s hard to get higher alpha generation than that,” Williams adds. “It’s largely a passive strategy.”

The managers may also look to add incremental alpha in the cash portion of the allocation through allocations to income funds.

“We’d only buy into large income funds of at least R5 billion, where we have daily liquidity,” Williams says. “These funds have a mix of assets, some of which are not necessarily that liquid.

“We don’t want to take credit risk ourselves, so will pay away to a fund manager for that skillset. But it will be to a maximum of 4% or 5% of the portfolio across a number of funds to reduce liquidity risk.”